Review: WEBINAR

United Arab Emirates & Qatar: New Opportunities and Considerations

for Multinational Companies

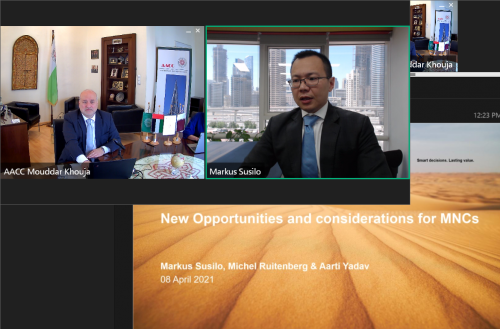

On 8 April 2021, AACC held the webinar “United Arab Emirates & Qatar: New Opportunities and considerations for Multinational Companies”, jointly organised with Crowe UAE.

AACC Secretary General Eng. Mouddar Khouja presented an overview of the historic, economic and trade relations among the Gulf Cooperation Council States prior to 2017, the demographic and economic characteristics pertaining to each of the UAE and Qatar and to the bilateral trade relations between the two neighbouring countries, in addition to the reconciliation meeting which resulted signing the Al-Ula Declaration by the GCC countries and Egypt early January 2021, and a business outlook and mutual economic benefits of reviving the GCC ties.

SG Khouja also highlighted the role that two major upcoming events, namely the FIFA World Cup 2022 in Qatar and Expo Dubai 2020 in the UAE, shall play in accelerating tourism not only within each of the two countries, but also between the two countries and among the GCC countries.

Crowe UAE, represented by Mr. Markus Susilo (Partner – Tax), Mr Michel Ruitenberg (Director – Tax) and Ms. Aarti Yadav (presenting on behalf of Mr Ruitenberg), provided a comparative overview of the corporate landscape of the UAE and Qatar and the tax implications for setting up a business in each of the two countries. They highlighted the key considerations for Qatar’s taxation and presented the different Qatari tax regimes. During the presentation, examples of a UAE company with a permanent establishment in Qatar and a Qatari company with a subsidiary in the UAE were illustrated, elaborating on the obligations of each entity.

Categories: Reports

Go to blog

Go to blog